-

Tourism, Tech, and Tough Competition: The Future of Cannabis in Nevada

Read more: Tourism, Tech, and Tough Competition: The Future of Cannabis in NevadaAs Nevada’s legal cannabis industry matures, dispensers and distributors find themselves navigating a complex terrain shaped by market saturation, evolving…

Recent Blog Posts

-

How Nevada Distributors Keep Cannabis Safe During Recalls

Read more: How Nevada Distributors Keep Cannabis Safe During RecallsIn the rapidly expanding cannabis landscape, product safety and integrity are paramount.…

-

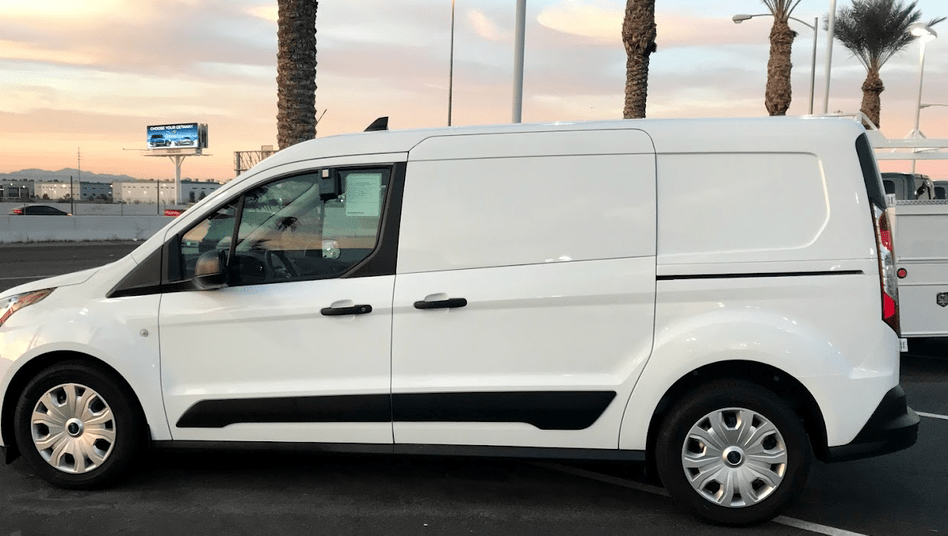

Beating the Desert Heat: How Nevada’s Cannabis Distributors Stay Cool

Read more: Beating the Desert Heat: How Nevada’s Cannabis Distributors Stay CoolHot summers in Nevada aren’t just tough on people—they put serious pressure…

-

Cooking with Cannabis: Grilled Steaks and Seafood Recipes

Read more: Cooking with Cannabis: Grilled Steaks and Seafood RecipesCooking with cannabis has gained popularity as a delicious way to combine…